The limited financial literacy in Spain restricts the uptake of lifetime mortgages.

The answer to, “What is happening with the lifetime mortgages in Spain?” is simple: The limited financial literacy in Spain restricts the uptake of lifetime mortgages.

In the financial world, there are various tools and products designed to help people secure their economic future. One of these options is the lifetime mortgage, a particularly relevant alternative for the population over 65 years old who own a home and need to supplement their pension or retirement income.

However, in Spain, the limited financial literacy has resulted in low awareness and consequently low usage of lifetime mortgages. In this article, we will explore the factors that explain this reality and the importance of promoting financial education for better decision-making.

What is a lifetime mortgage?

Before delving into the issue, it is important to understand what a lifetime mortgage is.

It is a financial product intended for people over 65 years old who own a home. Through this arrangement, the homeowner can convert a portion of their home’s value into liquid money, without the need to sell or abandon it. The resulting debt accumulates over time and is repaid when the homeowner passes away or decides to sell the property. It is an excellent option for obtaining additional income during retirement, covering medical expenses, or improving the quality of life in old age.

Limited financial literacy in Spain

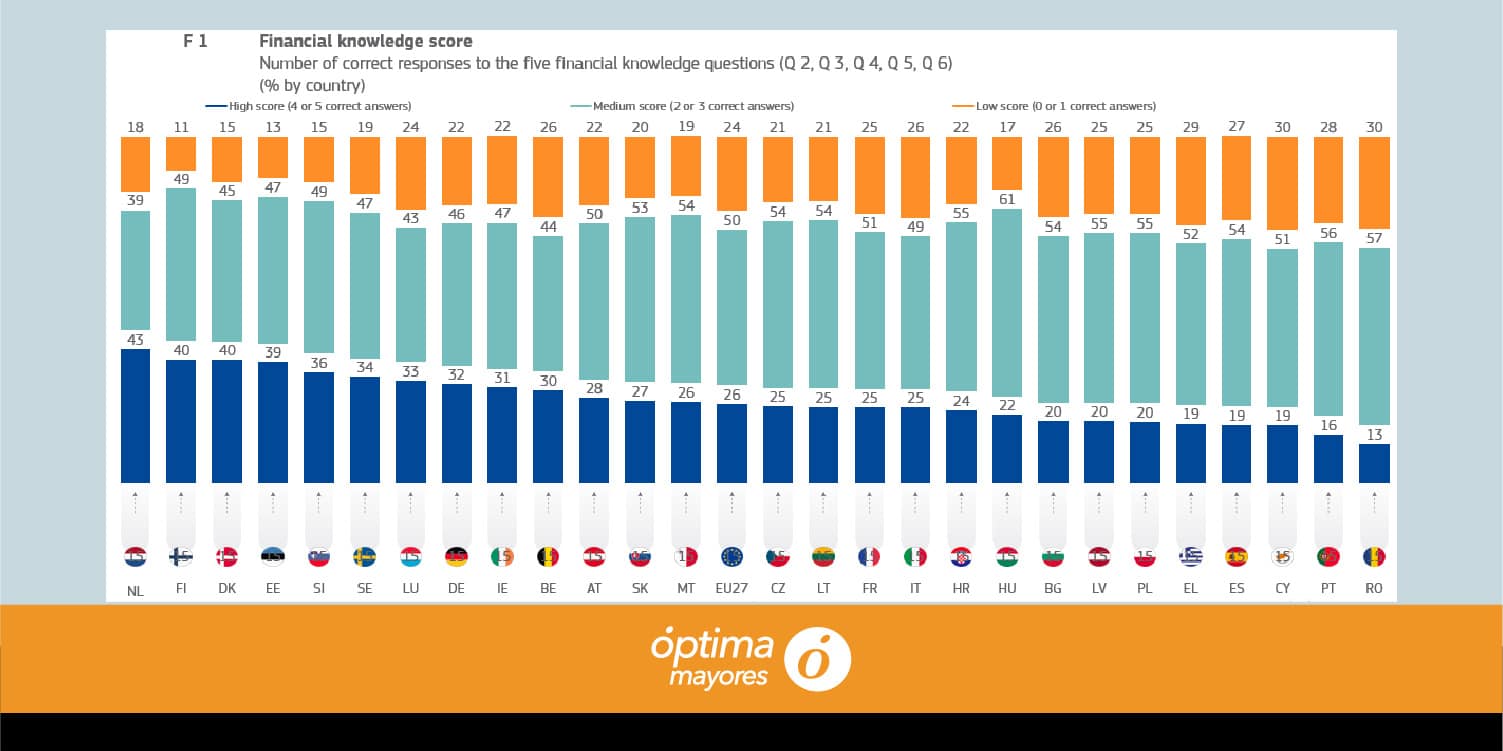

Spanish society faces a critical challenge, as exposed by the latest Eurobarometer: limited financial literacy, placing Spain only above Cyprus, Portugal, and Romania in terms of financial knowledge. This worrisome situation highlights the need for greater financial education to ensure better economic decision-making in daily life.

The Eurobarometer, a study conducted by the European Commission, revealed that the majority of Spaniards struggle to understand basic concepts of personal finance, such as saving, investing, and managing debts. Additionally, a large percentage of the population is unfamiliar with more complex financial products, such as life insurance, pension plans, and, most worryingly, the lifetime mortgage. The results of the Eurobarometer leave no doubt.

The lack of financial education leads to ignorance about how these products work, their benefits, and associated risks. As a result, many people are hesitant to consider these options, even when they could greatly benefit from them.

Fear of indebtedness

One of the factors explaining the low usage of lifetime mortgages is the fear of indebtedness. In Spanish culture, there is a widespread aversion to debt, and many older individuals are particularly cautious in this regard. They fear that a lifetime mortgage may compromise their family’s assets or leave them with excessive debt, leading them to dismiss this option without proper analysis.

Lack of transparency and past misconduct

In the past, there have been cases of misconduct in the Spanish financial sector that negatively affected the perception of financial products in general, including lifetime mortgages. The lack of transparency and unethical marketing practices have generated distrust among the population, making many people reluctant to consider any option involving their home.

Need for independent financial advice

Another key problem is the lack of access to adequate financial advice.

Many older individuals may feel disoriented or distrustful of financial services, making it difficult for them to obtain the necessary information to make informed decisions. Professional and honest financial advice is crucial in guiding potential beneficiaries of a lifetime mortgage and dispelling any unfounded concerns or fears.

Óptima Mayores, since 2005, has been a leader in the sector and advocates for direct, truthful information with maximum transparency.

The importance of promoting financial education and transparency in the sector

In conclusion, the limited financial literacy in Spain has contributed to restricting the use of lifetime mortgages as a viable option for the population over 65 years old. The lack of knowledge, fear of indebtedness, distrust caused by past misconduct, and the lack of adequate independent advice are the main obstacles that must be overcome. It is crucial to promote financial education and transparency in the sector so that people can make informed decisions about their economic future and consider lifetime mortgages as a valid and secure option to supplement their income in retirement and improve their quality of life